Private Markets 700

IFM Investors and FT Longitude elevate the global conversation on private markets

Once considered a niche investment class, private markets are fast becoming a cornerstone of global portfolios. That’s why IFM Investors and FT Longitude launched Private Markets 700, an ambitious global research programme that captured how institutional investors worldwide viewed and approached private market assets.

Private Markets 700 is IFM Investors’ most downloaded report to date and has cemented the firm as a thought-leading voice in private markets, aligning its brand with long-term value creation, resilience and sustainability in global investing.

Intelligence: Strategic insight

FT Longitude supported IFM Investors to uncover fresh insights into global market sentiment, surveying more than 700 senior investment professionals across pension funds, endowments, wealth managers and consultancies.

In close collaboration, we helped shape the research themes, survey design and analytical framework to shed new light on how investors engage with private markets.

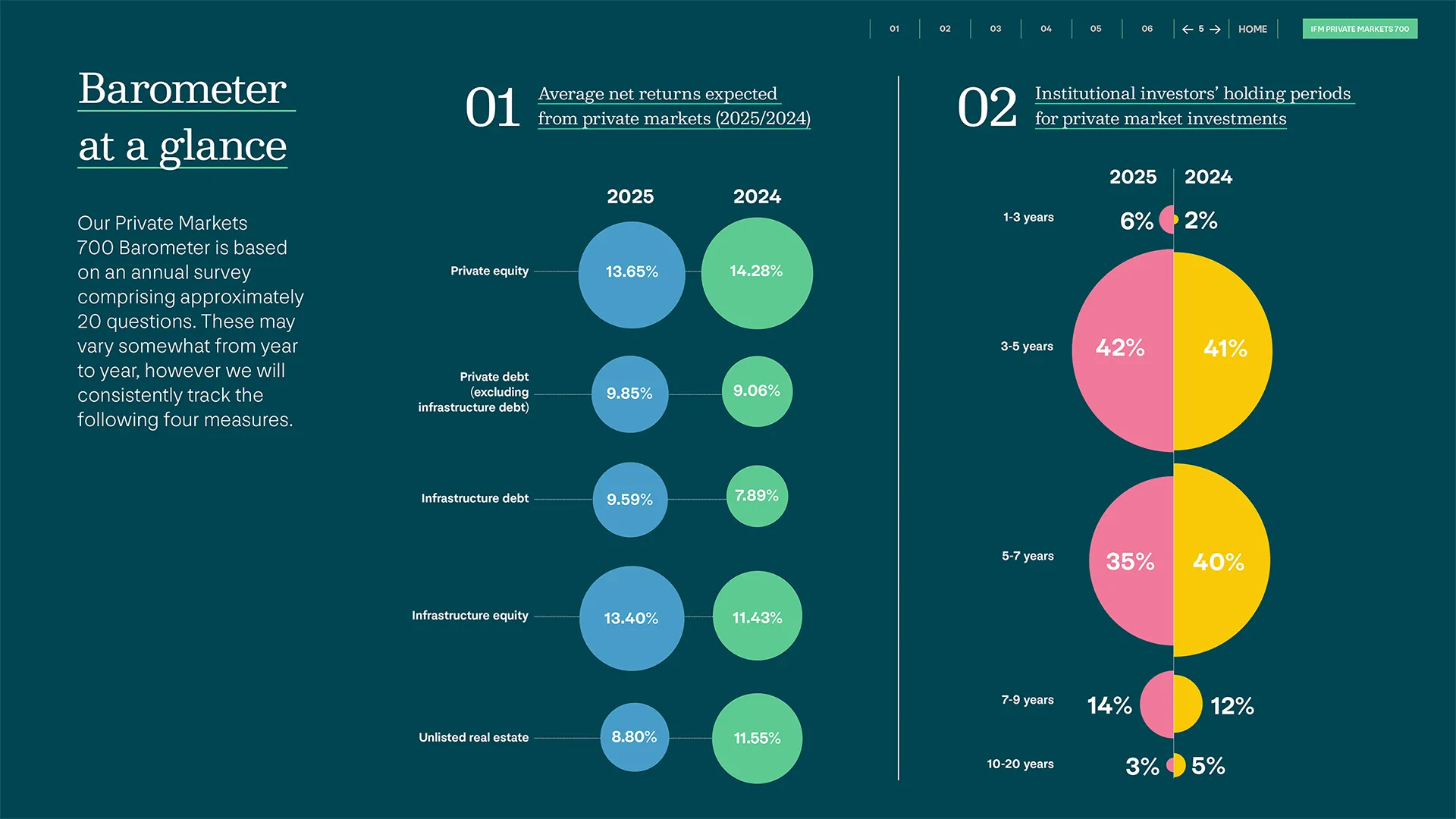

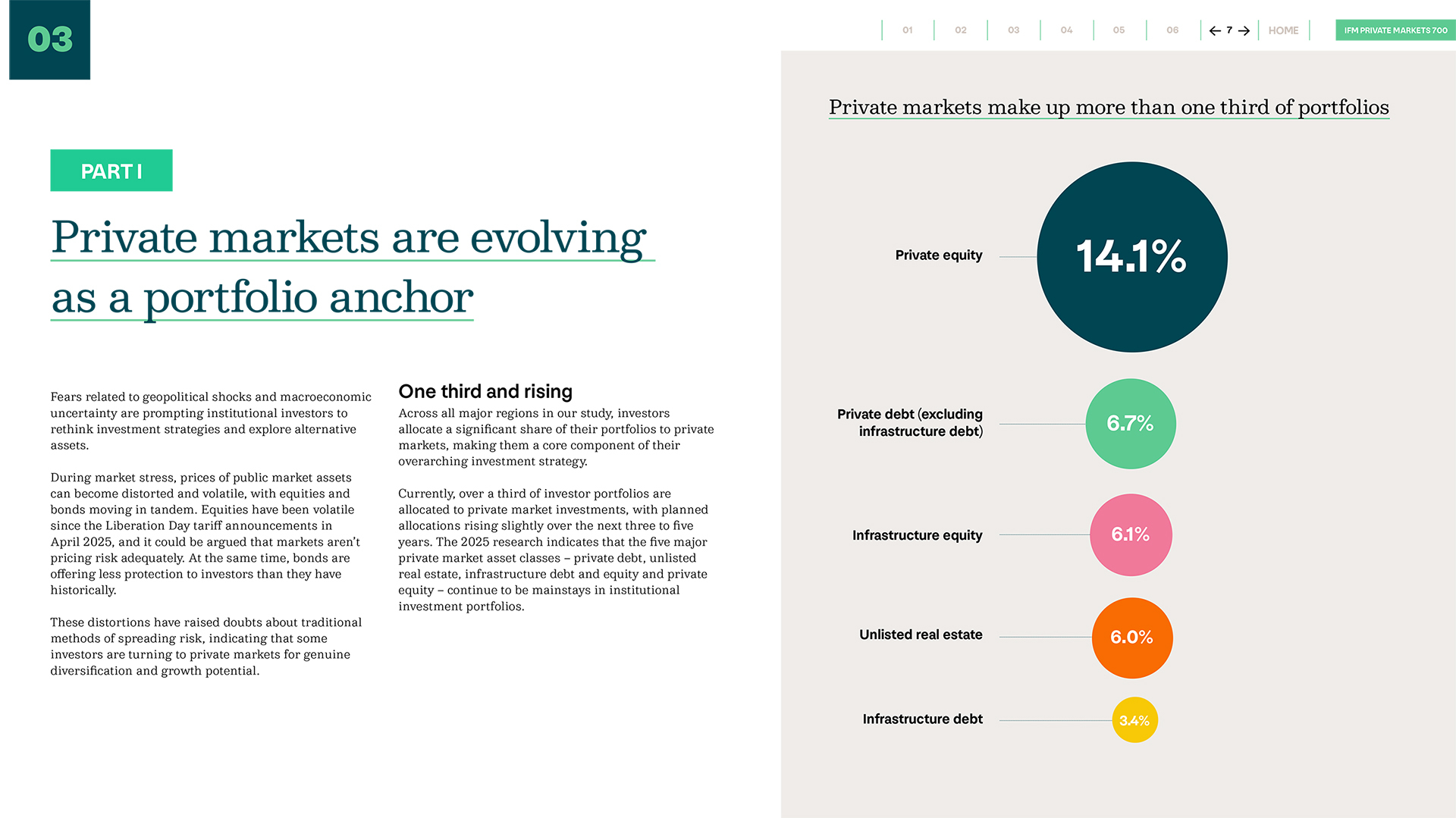

Blending rigorous quantitative analysis with expert commentary, the Private Markets 700 report surfaced industry-defining insights across a wide array of topics, all the way from AI and digitalisation to decarbonisation and supply chain management.

These insights are shaping institutional portfolios and the future of private market investing.

Influence: Capturing attention

The inaugural Private Markets 700 was designed not just as a piece of research, but as a strategic platform for thought leadership. By capturing the perspectives of investors across regions and asset classes, it positioned IFM Investors as a convener of global market intelligence and a trusted partner in navigating economic change.

The study attracted strong engagement across financial media, client networks and industry forums, as well as a significant increase in both reactions and comments on their social channels. It elevated IFM’s role in conversations around infrastructure finance, public-private capital collaboration, and sustainable investing.

Crucially, the report also established a benchmark for tracking investor sentiment year-on-year — setting the stage for a longitudinal study that will inform strategy, communications and client engagement.

Recognition

Following the success of the inaugural edition, the second iteration of the Private Markets 700 report is now live, further deepening IFM’s analysis on private markets’ evolving role in global portfolios.

Together, the two editions form a long-term intelligence programme that helps IFM Investors chart the future of private markets and infrastructure investing.

Private Markets 700 has become an award winning campaign and a central pillar of IFM Investors’ global thought leadership, delivering enduring value through data, insight, and influence.

Back

Back

Book a meeting

Book a meeting

Book a meeting

Book a meeting